oklahoma franchise tax due date 2021

Your Oklahoma return is due 30 days after the due date of your federal return. Interest at the rate of 125 per month shall be paid on the tax due from the original due date until paid.

Oklahoma Form 512 Corporate Income Tax Return Form And Schedules 2021 Oklahoma Taxformfinder

90 of the tax.

. Any taxpayer with a payment due by March 15 2021 andor April 15 2021 for 2020 Oklahoma income taxes andor any estimated 2021 income tax payment due by March 15 2021 andor April 15 2021 is granted a waiver of any penalties andor interest for payments not received by June 15 2021 Any taxpayer with an Oklahoma franchise tax return obligation will. Intercompany payables and receivables between parent subsidiary andor affiliates are to be eliminated from the calculations necessary to determine the amount of franchise tax due. If May 15 falls on a weekend or holiday the due date will be the next business day.

With the reorganization of the Oklahoma Tax Commission in 1995 came the refocus of the Tax Commissions goals and objectives. OK tax return filing and payment due date for Tax Year 2021 is April 18 2022Oklahoma State Individual Taxes for Tax Year 2021 January 1 - Dec. On this page we have compiled a calendar of all sales tax due dates for Oklahoma broken down by filing frequency.

The report and tax will be delinquent if not paid on or before September 15. T o avoid a. Oklahoma Franchise Tax is due and payable July 1st of each year or if you elected to change your filing date to be the same as the date of filing your corporate income tax the report and tax will be delinquent if not paid by the fifteenth 15 day of the third month following the.

Income reports and tax payment must be received by the fifteenth 15 day of the third month from the end of the corporations income tax year. See page 18 for methods of contacting the Oklahoma Tax Commission OTC. For assistance or forms.

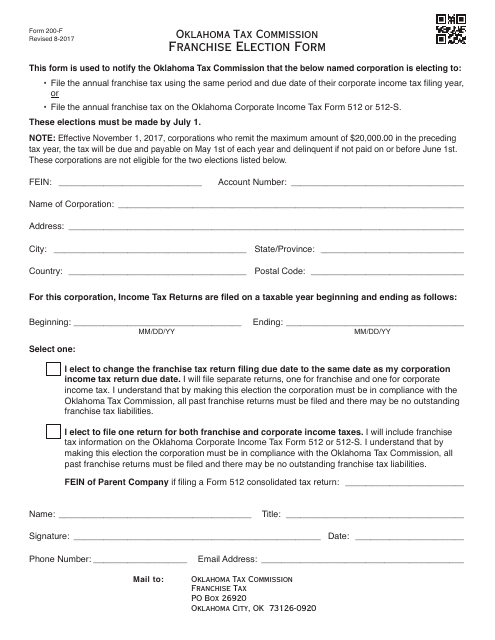

The remittance of estimated franchise tax must be made on a tentative estimated franchise tax return Form 200. The Oklahoma franchise tax is due by July 1st each year. Form 200-F Revised 9-2021.

Interest at the rate of 125 per month shall be paid on the tax due from the original due date until paid. Form 512-FT Computation of Oklahoma Consolidated Annual Franchise Tax Form 512-FT-SUP Supplemental Schedule for Form 512-FT Filing date. Franchise Tax Payment Options New Business Information New Business Workshop Forming a Business in Oklahoma Streamlined Sales Tax Forms Publications Forms - Business Taxes Forms - Income Tax Publications.

Depending on the volume of sales taxes you collect and the status of your sales tax account with Oklahoma you may be required to file sales tax returns on a monthly semi-monthly quarterly semi-annual or annual basis. These corporations are not eligible for the two elections listed below. 2019 Oklahoma Corporation Income and Franchise Tax Forms State of Oklahoma 2021 Form 514 Oklahoma Partnership Income Tax Return Packet Instructions State of Oklahoma.

31 2021 can be prepared and e-Filed now with an IRS or Federal Individual Tax Return or you can learn how to complete and file only an OK state returnFind IRS or Federal Tax Return deadline details. For these corporations franchise tax is due and payable on May 1 of each year and delinquent if not paid on or before June 1. Oklahoma Franchise Tax Instructions 2021 Oklahoma Franchise Tax Instructions 2021 2020 oklahoma franchise tax instructions.

Due Dates Annual Franchise Tax Reports The annual franchise tax report is due May 15. Affected taxpayers have until June 15 2021 to file most returns that have an original or extended due date occurring on or after February 8. See page 16 for methods of contacting the Oklahoma Tax Commission.

Mail Form 504-C Application for Extension of Time to File an Oklahoma Income Tax Return for Corporations Partner-ships and Fiduciaries with payment if applicable to. Registrants can change their entitys tax filing date to the same schedule of filing as their corporate income and franchise taxes. Pursuant to OAC 71050-17-1 the Oklahoma Small Business Corporation Income and Franchise Tax Return must be filed electronically.

Effective November 1 2017 corporations who remit the maximum amount of 2000000 in the preceding tax year the tax will be due and payable on May 1st of each year and delinquent if not paid on or before June 1st. Oklahoma Tax Commission PO Box 26890 Oklahoma City OK. Below are all state agencies currently utilizing OKgovs Online Bill Pay System.

If a taxpayer computes the franchise tax due and determines that it amounts to 25000 or less the taxpayer is exempt from the tax and a no tax due form is required to be filed. 2020 Tax Payment Deadline Extension. The following is the Tax Commissions mission statement as it exemplifies our.

Any taxpayer with an Oklahoma franchise tax liability due and payable on or before July 1 2021 will be granted a waiver of any penalties andor interest for returns filed by August 1 2021 provided payment is received by September 15 2021. Oklahoma Franchise Tax is due and payable July 1st of each year unless a Franchise Election Form Form 200-F has been filed. Final Franchise Tax Reports Before getting a Certificate of Account Status to terminate convert merge or withdraw registration with the Texas Secretary of State.

Your Oklahoma return is due 30 days after the due date of your federal return. Select the service you would like to access below. Oklahoma franchise excise tax is levied and assessed at the rate of 125 per 100000 or fraction thereof on the amount of capital allocated or employed in.

2019 Oklahoma Corporation Income and Franchise Tax Forms State of Oklahoma 2021 Form 514 Oklahoma Partnership Income Tax Return Packet Instructions State of Oklahoma. A ten percent 10 penalty and one and one-fourth percent 125 interest per month is due on payments made after the due date.

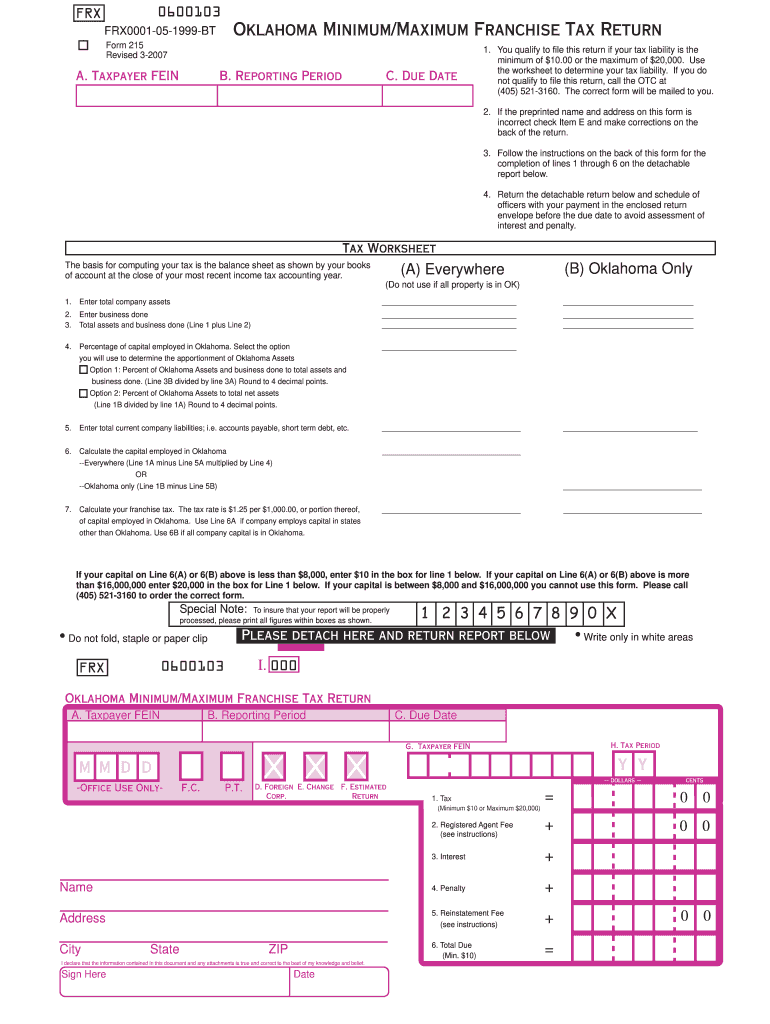

2007 2022 Form Ok Otc 215 Fill Online Printable Fillable Blank Pdffiller

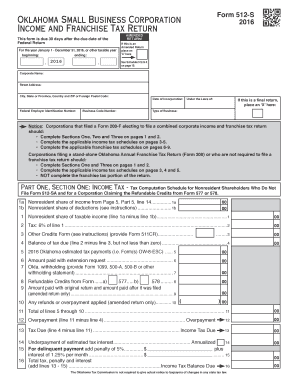

Fillable Online Form 512 S Fax Email Print Pdffiller

2021 Federal State Tax Deadline Extension Update Picnic S Blog

Fill Free Fillable Forms For The State Of Oklahoma

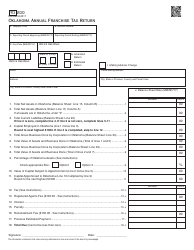

Otc Form Frx200 Download Fillable Pdf Or Fill Online Oklahoma Annual Franchise Tax Return Oklahoma Templateroller

What Is Franchise Tax Overview Who Pays It More

2007 2022 Form Ok Otc 215 Fill Online Printable Fillable Blank Pdffiller

Otc Form Frx200 Download Fillable Pdf Or Fill Online Oklahoma Annual Franchise Tax Return Oklahoma Templateroller

Irs Announced Federal Tax Filing And Payment Deadline Extension The Turbotax Blog

Solved Oklahoma Nonresident Tax Return Ok 511 Nr Intuit Accountants Community

2021 Form Ok Frx 200 Fill Online Printable Fillable Blank Pdffiller

What Is Privilege Tax Types Rates Due Dates More

Otc Form 200 Download Fillable Pdf Or Fill Online Oklahoma Annual Franchise Tax Return 2020 Templateroller

State Income Tax Extensions Weaver Assurance Tax Advisory Firm

Complete And E File 2021 2022 Oklahoma Income State Taxes

2020 Tax Deadline Extension What You Need To Know Taxact

Otc Form 200 F Download Fillable Pdf Or Fill Online Franchise Election Form Oklahoma Templateroller